Our Services

Plan Design & Implementation

Plan Design & Implementation

We design and implement retirement plans tailored to your organization’s primary objectives. We identify your needs, budgeting restraints, and basic provisions to maximize business efficiency and tax benefits. TWG’s professional staff will guide you through each step of the process including:

- Review the employer’s controlled group and/or affiliated service group status.

- Design a plan tailored to meet the needs of the owners, employees, and the business itself.

- If we are taking over a plan already in existence, we will review the existing plan provisions and recommend changes to fully meet the employer’s goals and objectives.

- Provide plan documentation as required by the IRS.

- Request IRS determination letter, if applicable.

- Provide the Summary Plan Description (SPD) that is required to be distributed to plan participants.

- Prepare customized enrollment and administrative materials.

- Conduct employee meetings to communicate the provisions of the plan.

Consulting Services

Consulting Services

Retirement laws are complex and, as such, we believe it is necessary to have an open line of communication to provide understanding of the provisions and governing regulations concerning your plan.

Third-Party Administration (TPA) Services

Third-Party Administration (TPA) Services

TWG provides all on-going services for Defined Contribution and Defined Benefit Plans to maintain plan compliance with retirement regulations.

Among the broad range of consulting and compliance services offered by TWG are defined benefit/actuarial services. Defined benefit plans (including cash balance plans) may be administered by TWG either on a stand-alone basis, or in conjunction with a defined contribution plan as part of a DB/DC combination plan arrangement. Our professional staff has the expertise and up-to-date technology to provide the necessary actuarial and administrative assistance to manage your defined benefit plan:

- Calculate employee eligibility and plan entry.

- Maintain all participant records, including benefit and vested percentage.

- Determine eligibility to receive benefit accrual.

- Prepare comprehensive Employer/Trustee annual actuarial report and certification.

- Actuarial determination of required employer contributions.

- Preparation of individual benefit statements.

- Distribution processing: Calculation of distribution amount and preparation of required distribution notices, release forms and IRS reporting.

We perform the following services in order to provide smooth and efficient plan operation:

- Calculate employee eligibility and plan entry.

- Maintain all participant records, including employee and employer contributions, forfeitures, investment gains and losses, and vested percentage.

- Assist employers in processing each payroll and allocating contributions and loan payments according to the participant’s investment elections.

- Preparation of comprehensive employer/trustee reports.

- Determine eligibility for, and allocation of, employer contributions and forfeitures.

- Preparation of all administrative forms.

- Monitor compliance and testing as required under IRS regulations (see below).

- Allocate forfeitures, if applicable.

- Distribution processing: Calculation of distribution amount, preparation of required distribution notices, release forms and IRS tax reporting.

- Loan processing: Set up of loan accounts, preparation of promissory note and amortization schedule, and tracking loan repayments.

- Hardship withdrawal processing: Determination of hardship distribution amount and preparation of application forms.

- Reconcile trust accounts.

- Prepare customized participant statements.

- Monitor participants who are required to receive age 70½ distributions.

TWG’s service offerings range from fully-Bundled Arrangements to Unbundled Arrangements, allowing employers the flexibility to craft a retirement program best suited to the needs of both the business and its employees.

Under a “Bundled” Arrangement, TWG will serve as both daily valuation record keeper and third-party administrator (TPA):

- TWG creates a sophisticated structure of "open architecture" recordkeeping and a strategic investment platform that provides unparalleled investment choice--allowing clients to select a collection of mutual funds and ETFs that is virtually unlimited. TWG’s advisors ensure that custom models are personalized for each plan participant, while also ensuring that the client, participants, and investment advisor are able to manage the ongoing operation of the plan and empowering employees to manage their investments to maximize their retirement investments.

Under an “Unbundled” Arrangement TWG will serve as either:

- TPA, with investments and recordkeeping services delivered by another provider or

- TWG serving as daily valuation record keeper and acting as a supportive partner to outside advisors and TPA firms that do not have recordkeeping functionality.

Annual Compliance Testing and Government Reporting

Our professional staff has the knowledge and expertise to help keep your retirement plan in compliance with federal laws and regulations and, should violations occur, our staff can provide methods of correction. We provide the following services, if applicable:

- Monitoring of qualification requirements (§401)

- Minimum participation testing (§401(a)(26))

- Contribution deductibility calculations (§404)

- Minimum coverage testing (§410)

- Monitoring of minimum vesting standards (§411)

- Monitoring compliance with Definitions and Special Rules (§414)

- Annual addition of benefits and allocations testing (§415)

- Top heavy testing (§416)

- ADP/ACP testing (applicable to 401(k) plans)

- Preparation of DOL/IRS Form 5500 and related schedules

- Preparation of Summary Annual Report for participants

- Preparation of appropriate PBGC form (for defined benefit plans only)

- Preparation of AFTAP certification (for defined benefit plans only)

Consulting Services

- Plan amendments, terminations, and mergers

- Assist with IRS and DOL audits under Power of Attorney

- Provide assistance with plan design changes

- Conduct special plan or participant benefit studies or projections

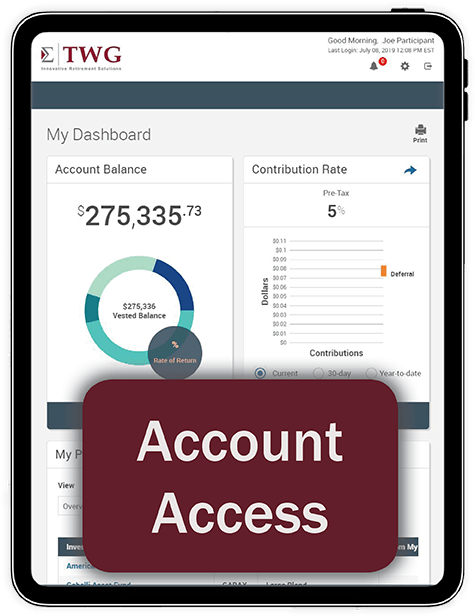

Recordkeeping

Recordkeeping

We provide daily recordkeeping for Defined Contribution Plans to track assets and ensure accurate allocation.

TWG Payroll360

TWG Payroll360

TWG Payroll360 seamlessly integrates with leading payroll providers, relieving our clients’ task of transmitting the information. Census and contribution data is transmitted automatically for employers every pay period. With integration, employee contribution changes in TWG’s Retirement Plan Management System are sent automatically and updated in the employer’s payroll system. TWG Payroll—it just works!

TWG Payroll360 integrates with the following providers: